Repeating the Big Short: Ending Fannie and Freddie's Conservatorship Risks Another Crisis

The movie "The Big Short" -- dramatizing the reckless behavior in the banking and mortgage industries that contributed to the 2008 financial crisis -- captures much of Wall Street's misconduct but overlooks a central player in the collapse: the federal government, specifically through Fannie Mae and Freddie Mac.

These two government-created and government-sponsored enterprises encouraged lenders to issue risky home loans by effectively making taxpayers cosign the mortgages. This setup incentivized dangerous lending practices that inflated the housing bubble, eventually leading to catastrophic economic consequences.

Another critical but overlooked factor in the collapse was the Community Reinvestment Act. This federal statute was intended to combat discriminatory lending practices but, starting in the 1990s, instead created substantial market distortions by pressuring banks to extend loans to borrowers who might otherwise have been deemed too risky. Under threat of regulatory penalties, banks significantly loosened lending standards -- again, inflating the housing bubble.

After the bubble inevitably burst, Fannie and Freddie were placed under conservatorship by the Federal Housing Finance Agency. The conservatorship imposed rules aimed at preventing future taxpayer-funded bailouts and protecting the economy from government-fueled market distortions.

Now President Donald Trump's appointee to lead that agency, Bill Pulte, is considering ending this conservatorship without addressing the core structural flaw that fueled the problem in the first place: implicit government guarantees backing all Fannie and Freddie mortgages. If Pulte proceeds without implementing real reform, taxpayers on Main Street are once again likely to be exposed to significant financial risks as they are conscripted into subsidizing lucrative deals for Wall Street.

Without genuine reform, the incentives and practices that led to the crisis remain unchanged, setting the stage for a repeat disaster.

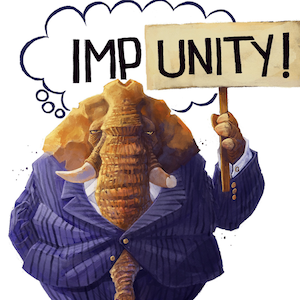

Pulte's proposal isn't likely to unleash free-market policies. Instead, it could further rig the market in favor of hedge funds holding substantial stakes in Fannie and Freddie, allowing them to profit enormously from the potential upside, while leaving taxpayers to bear all the downside risks.

A meaningful solution requires Fannie and Freddie to significantly strengthen their capital reserves. The two government-sponsored enterprises still remain dangerously undercapitalized. A report from JP Morgan Chase describes it this way: "Despite steady growth in (their net worth), the GSEs remain well below the minimum regulatory capital framework requirements set by the Federal Housing Finance Agency in 2020." Imposing robust capital requirements similar to those that govern private banks would oblige the two enterprises to internalize their risks, promoting genuine market discipline and accountability.

Further reforms should focus on transparency and oversight. Stronger disclosure requirements would enable investors, regulators and the public to evaluate financial risks better. Limiting the types of mortgages that Fannie Mae and Freddie Mac can guarantee would also reduce their exposure to high-risk loans, providing additional protection to taxpayers. Clear regulations preventing these entities from engaging in speculative financial products would further decrease market distortions.

Most importantly, the federal government must be explicit that future bailouts are off the table. While this stance might be challenging to enforce, eliminating, in theory, implicit government guarantees would encourage Fannie and Freddie to operate more responsibly than they have in the past. They would recognize that reckless behavior would lead to insolvency rather than to another taxpayer-funded rescue. Establishing a definitive legal separation from government backing is crucial to reducing moral hazard.

Historically, the combination of implicit government guarantees, regulatory pressures from policies such as the Community Reinvestment Act, and insufficient capital requirements created the perfect conditions for the 2008 financial crisis. Ignoring these lessons and repeating past mistakes would inevitably set the stage for another financial disaster.

Proponents of prematurely releasing Fannie and Freddie argue that market conditions have changed and risk management has improved. Yet history repeatedly demonstrates that without structural changes, financial entities -- particularly those shielded by government guarantees -- inevitably revert to risky behavior when market pressures and profit incentives align. Markets function best when participants bear the full consequences of their decisions, something impossible under the current structure of these government-sponsored enterprises.

Ultimately, the only responsible approach is removing taxpayers from the equation entirely. Fannie Mae and Freddie Mac should participate in the mortgage market only as fully private entities, without any implicit government guarantees.

The American public doesn't need a sequel to "The Big Short." The painful lessons of the 2008 crisis are too recent and too severe to be ignored or forgotten. Market discipline, fiscal responsibility and genuine reform -- not government-backed risk-taking -- must guide our approach going forward. We can only hope that the Trump administration chooses fiscal responsibility over risky experiments that history has already shown end in disaster.

Veronique de Rugy is the George Gibbs Chair in Political Economy and a senior research fellow at the Mercatus Center at George Mason University. To find out more about Veronique de Rugy and read features by other Creators Syndicate writers and cartoonists, visit the Creators Syndicate webpage at www.creators.com.

----

Copyright 2025 Creators Syndicate, Inc.

Comments