At Seattle's Filson, challenge of reshoring US factory jobs is clear

Published in Business News

As U.S. politicians promise to rebuild American manufacturing with tariffs, the transformation of Filson, Seattle-born maker of rugged, high-end apparel, shows just how complicated that task could be.

At Filson’s flagship store-workshop on First Avenue South, visitors can still watch workers busily assembling the company’s $550 Filson Mackinaw Cruisers, $325 Western Vests and $275 Mackinaw Wool Vests.

But those three are the only items still made at the shop, out of hundreds in the 128-year-old company’s current catalog.

And the busy production staff, which was recently transferred from Filson’s soon-to-close facility in Kent, numbers just 12 — a fraction of the company’s local production team from even a decade ago.

In 2016, four years after Filson was acquired by Texas-based Bedrock Manufacturing, it employed roughly 160 production workers in the Seattle area, according to the workers’ union.

The shrinking of Filson’s Seattle-area manufacturing workforce parallels the broader decline in U.S. apparel production as companies have grappled with pandemic-related disruptions and inflation on top of decades of foreign competition.

In 2015, The Seattle Times reported that Filson made 90% of its clothes, bags and other products in the United States, including in Seattle workshops.

Today, according to Filson, just 35% of its products are made in the U.S., much of that by an outside vendor near Los Angeles, where Filson outsourced two-thirds of its remaining Seattle-area manufacturing, starting in late 2023.

Third parties

Filson’s total Seattle-area workforce has fallen from 369 in 2015 to around 130 today. It will drop under 100 this summer, following the company’s decision last month to lay off 31 remaining staff at the Kent facility, which also housed distribution operations.

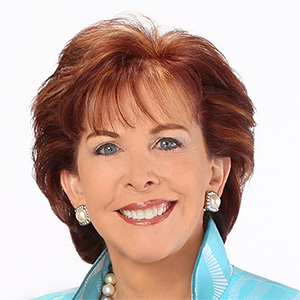

Filson “has changed drastically,” said Jon Pryor, 63, a warehouse lead in Kent who has worked for Filson since 2017, when the company still had significant U.S. production, including in Seattle.

In recent years, said Pryor, much of his job has involved garment imports from places like Sri Lanka and Bangladesh, where wages are a fraction of what companies like Filson pay in the U.S.

And even that task will go away when Filson closes the Kent warehouse in August and outsources distribution to a third-party vendor in Mississippi.

For Victoria Cortez, 21, who works in the receiving department and had been expecting a promotion, the closure comes as a “shock.”

But veterans like Pryor said the decision wasn’t a surprise, given how Filson and Bedrock have been trying to cut costs.

A vendor in Mississippi isn’t “going to have to pay what they’re paying us here,” said Pryor, who is also a member of the bargaining team for United Food & Commercial Workers Local 3000.

The union and Filson recently agreed on a severance package for departing workers and a new contract for the dozen or so unionized Filson employees who still work in the Seattle area.

Bedrock says cost-cutting isn’t the main reason behind Filson’s shrinking Seattle presence.

Shifting distribution to Mississippi gives Filson access to “more advanced technology and a more central location” and means “improved shipping times and return services to its customers,” a Filson spokesperson said this week.

Those “efficiency” arguments dovetail with efforts by Bedrock, which also owns watchmaker Shinola, to run the different brands through shared back-office operations, as CEO Steven Katzman told ModernRetail in September.

Quality materials, skilled labor

Still, rising costs have been a challenge for apparel-makers, and especially higher-end operators like Filson that rely heavily on skilled labor.

Founded in 1897 during the Alaska gold rush, Filson became known for high-quality apparel that was tough enough for prospectors, cowboys, loggers and other outdoor workers.

By the early 2000s, Filson had leveraged the reputation into an upscale brand for high-end customers who “don’t bat an eye at paying $130 for a wool shirt; $219 for a sweater, $22 for a pair of socks,” as a 2005 Seattle Times article noted.

But beneath the clever marketing, Filson’s success has continued to depend on product quality, which relies in turn not just on good materials but skilled labor.

Labor makes up roughly half the cost of making outdoor apparel, said Brent Zwiers, a production expert who formerly worked at Filson and two other Seattle-based outdoor apparel companies — Outdoor Research and Feathered Friends.

In recent decades, much of that labor has been done by Chinese and Vietnamese immigrants who often brought their skills with them, said Zwiers.

But that need for skilled labor is a challenge in a competitive global economy.

In the U.S., the median hourly wage for sewing machine operators in “cut and sew apparel manufacturing” is $16.06, or around $32,000 a year, according to a 2023 report by the U.S. Bureau of Labor Statistics.

That’s around 40% below the median U.S. wage. But it’s many times higher than what some workers make overseas.

In Bangladesh, which has grown into a major supplier for many U.S. apparel brands, the minimum wage for apparel workers was raised in 2023 to the equivalent of just over $1,350 a year, according to media reports and a 2024 report from the U.S. Department of Labor.

Tariffs to the rescue?

President Donald Trump wants to boost U.S. manufacturing by putting tariffs, or taxes, on imports, thus neutralizing the advantages of lower-cost foreign labor.

But that help is complicating life for U.S. apparel companies that now rely on imports for some or all of their products and materials. Today, just 2% of the garments Americans buy are U.S.-made, according to data reported in The New York Times.

Tariffs are even more complicated for higher-end brands whose customers are already price-fatigued from recent inflation.

Filson is seeing both effects.

On the one hand, having 35% of its production still in the U.S. “mitigates impact from tariffs on a meaningful portion of our product line,” said Filson’s new president, Tim Bantle, in a statement this week.

“That said, on the balance of our goods, we need to manage the impact of tariffs,” which comes “on top of the inflationary impact of the COVID era and a resetting of consumer spending as a result,” added Bantle, who was formerly CEO of Seattle-based outdoor apparel giant Eddie Bauer.

Asked about the impacts of the tariffs going forward, Bantle said Filson is “still assessing the situation while staying focused on delivering Filson-level quality and value to our customers.”

Seattle presence

However Filson ends up delivering that quality and value, it’s not entirely clear what Seattle’s role will be.

The company said moving the 12 production workers from Kent to Seattle is “a return to its roots” and added that it plans to expand some production in Seattle.

But the company was also careful to note that more Seattle production won’t require a larger Seattle-area manufacturing team, which appears to have remained at around a dozen since the big layoff in 2023.

More broadly, even if Filson wanted to rebuild its Seattle-area manufacturing team, it might struggle to find enough skilled labor.

Many garment workers in immigrant communities are aging out and aren’t passing those skills on to their children, Zwiers said.

Many “worked really hard to send their kids to school so that they wouldn’t have to … work in the factories anymore,” Zwiers said.

In the Seattle area, skilled apparel labor has become so scarce that when Outdoor Research wanted to expand production, around six years ago, the company had to look elsewhere and eventually settled on the Los Angeles area, which still has a lot of apparel workers, Zwiers said.

In Washington, “it’s a small pool that keeps getting smaller.”

Between 2001 and 2024, the number of apparel workers in Washington fell by nearly two-thirds, from 3,086 to just 1,129, with around 778 in King County, according to state data through mid-2024.

Reversing that decadeslong trend will likely take more than tariffs.

Pay remains low, especially relative to living costs in cities like Seattle. Even with the new union contract, Filson’s apparel-makers will earn around $21 to $26 an hour, according to UFCW. The city’s minimum wage is $20.76.

And to get those wages, job applicants must have skills that have become harder to acquire as the domestic apparel industry has shrunk.

Reversing that decadeslong trend will likely take more than tariffs.

Pay remains low, especially relative to living costs in cities like Seattle. Even with the new union contract, Filson’s apparel-makers will earn around $21 to $26 an hour, according to UFCW. The city’s minimum wage is $20.76.

And to get those wages, job applicants must have skills that have become harder to acquire as the domestic apparel industry has shrunk.

©2025 The Seattle Times. Visit seattletimes.com. Distributed by Tribune Content Agency, LLC.

Comments