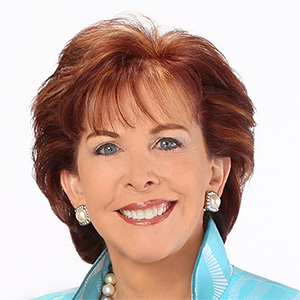

Inflation stayed steady last month as Trump's tariffs hit some prices -- here's what might feel most expensive

Published in Business News

Inflation didn’t improve last month, suggesting that businesses may be starting to pass along higher costs from tariffs onto the prices that you see on store shelves.

Consumer prices rose 0.2% between June and July, according to the Bureau of Labor Statistics (BLS)’ latest monthly consumer price index (CPI) report. Excluding food and energy, a measure of “core” or “underlying” inflation rose 0.3%, the most since January. Many items currently exposed to tariffs — from coffee and tomatoes to toys, sporting equipment, household furnishings and apparel — continued to climb. Used cars and trucks rose the most since September 2022.

More price hikes could also still be coming down the pipeline, after higher tariff rates from key U.S. trading partners took effect earlier this month.

The majority of economists (41%) expect inflation to stay elevated through 2027, primarily driven by higher import taxes, according to Bankrate’s latest Economic Indicator Survey. Meanwhile, Fed officials have said that uncertainty over how tariffs could impact inflation is the main reason rate cuts are on hold.

A little bit of inflation is good for consumers. The economy keeps growing and businesses continue expanding, hiring workers and bumping up their pay along the way. Too much inflation, however, feels akin to taking a pay cut. High inflation has consequences beyond just affordability, complicating saving for emergencies or investing for retirement.

Since the pandemic, consumer prices are 24.3% more expensive, a Bankrate analysis of Bureau of Labor Statistics data shows. That price burst means Americans need about $1,243 to buy the same goods and services that cost $1,000 when the coronavirus-induced recession occurred.

Looking for the latest information on consumer prices? Here’s a round-up of where inflation is improving — and where it’s still remaining stubborn.

Highlights of the latest statistics on inflation

—Prices in July rose 2.7% from a year ago, matching last month’s 2.7% annual rate, according to the Bureau of Labor Statistics consumer price index (CPI).

—Prices excluding food and energy (core inflation) edged up to 3.1% last month, the highest since February, according to the BLS.

—Shelter costs were the primary driver of inflation in May, the BLS said. Medical care, airline fares, recreation, household furnishings and operations, as well as used vehicles also increased last month. Lodging, energy and grocery prices fell.

What is the current inflation rate?

Over the past 12 months, prices have risen 2.7% from a year ago, the BLS’ CPI report showed. Excluding food and energy, “core” prices rose 3.1% annually.

Inflation is well below where it peaked in the summer of 2022. Yet the figures reflect bumpier progress on inflation’s path back to the Fed’s 2% target. Inflation was staying stubbornly above the Fed’s goal even before President Donald Trump lifted tariffs to the highest since the Great Depression.

Prices that are rising the most

Of the nearly 400 items that BLS tracks, roughly 3 out of every 4 items (or 76%) increased in price between July 2024 and July 2025. One in 4 (or 25%) were cheaper in July than they were a year ago.

According to BLS, these are the prices that increased most over the past year (July 2024-July 2025 increase):

Eggs: 16.4%

Roasted coffee: 14.8%

Instant coffee*: 14.3%

Utility (piped) gas service: 13.8%

College textbooks*: 12.9%

Uncooked beef steaks: 12.4%

Audio equipment: 12.4%

Other condiments: 12.1%

Uncooked ground beef: 11.5%

Beef and veal: 11.3%

(*Denotes an item that isn’t seasonally adjusted.)

Month-over-month price changes, however, can give consumers a more real-time look at the prices that have recently been popping. Lower prices in the same year-ago period, for example, can cause an item to look like it’s gaining speed, when it’s slowing in reality.

Case in point: Utility piped gas services prices were cheaper in July than they were in June, even though they’re still up 13.8% from a year ago.

Consumers, however, should take seasonal variations into account. Back-to-school or tax season, for instance, can often contribute to higher prices on items like tax return preparation services or college textbooks. BLS doesn’t seasonally adjust all of its items, and year-over-year inflation rates can better smooth out those variations.

According to BLS, these are the prices that increased most over the past month (June 2025-July 2025 increase):

Frozen noncarbonated juices and drinks*: 5.3%

Other motor fuels: 4.5%

Cookies: 4.2%

Airline fares: 4%

Lettuce: 4%

Ham, excluding canned: 3.9%

Tax return preparation and other accounting fees: 3.5%

Infants’ and toddler’s apparel: 3.3%

Tomatoes: 3.3%

Public transportation: 3%

(*Denotes an item that isn’t seasonally adjusted.)

Why is inflation still hot right now?

Consumers might notice just how much more expensive egg prices are from a year ago and wonder why the overall inflation rate is just 2.7%. To put it simply, the Bureau of Labor Statistics assigns weights to each individual good or service it tracks, based on how prevalent it’s considered to be in a consumer’s monthly budget.

Over the past year:

—Shelter has accounted for roughly half (or 48%) of the increase in inflation;

—Food has accounted for 14% of inflation; and

—Car insurance has accounted for 6% of inflation.

Yet, in a sign that tariffs are contributing to the recent increase in inflation, core goods prices (excluding food and energy) accounted for one-fifth (or 20%) of overall inflation between June and July.

The drivers of inflation have changed dramatically since the initial post-pandemic price burst. When price pressures peaked in June 2022, shelter contributed just 20% of the annual increase in prices. But as consumers emerged from lockdowns with massive pent-up demand at the same time as global supply shortages, goods prices were driving the majority of price pressures, accounting for more than half (58%) of inflation between June 2021 and 2022. Energy was also responsible for about a third (32%) of inflation.

To combat inflation, officials on the Federal Reserve lifted borrowing costs from a rock-bottom level of near-zero percent to a 23-year high of 5.25%-5.5%. Now, borrowing costs are in a target range of 4.25%-4.5%.

Post-pandemic inflation: What’s risen the most and what’s gotten cheaper

Of the nearly 400 items BLS tracks, just 28 (or roughly 7%) are cheaper today than they were pre-pandemic.

To be sure, prices are expected to rise in the healthiest of economies — though only gradually, at a goal of around 2% a year.

According to BLS, these are the top 10 items that have jumped the most in price since the pandemic (February 2020-July 2025 increase):

Eggs: 86.5%

Frozen noncarbonated juices and drinks*: 62.7%

Motor vehicle repair: 58.4%

Motor vehicle insurance: 56.6%

Margarine: 56.6%

Utility (piped) gas service: 54%

Uncooked beef roasts: 53.2%

Uncooked other beef and veal*: 52%

Uncooked beef steaks: 48%

Beef and veal: 47.8%

(*Denotes an item that isn’t seasonally adjusted.)

Meanwhile, the items that have dropped in price the most since the pandemic are primarily goods and electronics — largely thanks to improving supply chains (February 2020-July 2025 decrease):

Smartphones*: -60%

Telephone hardware, calculators, and other consumer information items: -50.4%

Televisions: -30.1%

Information technology commodities: -27.5%

Education and communication commodities: -23.6%

Computer software and accessories*: -14.7%

Health insurance*: -14.6%

Video and audio products: -11.9%

Other video equipment: -11.2%

Dishes and flatware: -11.1%

(*Denotes an item that isn’t seasonally adjusted.)

Inflation breakdown by product category

Looking for an easy analysis of how inflation is impacting the key items in your budget? Here’s what Bankrate found.

—Gas

Gasoline prices aren’t rising as rapidly as they once were. Technically, prices are 9.5% cheaper than they were a year ago — after soaring as high as 59.8% in June 2022. Even so, prices at the pump cost about 15.3% more than before the pandemic.

Energy prices, however, tend to be volatile. For instance, gas prices declined 2.2% in July after a 1% increase in June.

—Food

Grocery prices (formally known as food at home) rose 2.2% from a year ago and are about 28% more expensive than they were before the pandemic, BLS data indicates. At their peak, grocery prices soared 13.6% in August 2022 from a year ago.

Of the major shopping categories:

Meats: up 5.7% over the past year and 34.6% since February 2020

Fish and seafood: up 1.7% from a year ago and 17.9% since the start of the pandemic-induced recession

Dairy: up 1.5% over the past year and 21.4% more expensive since the pandemic

Fruits and vegetables: up 0.3% over the past year but 18.1% more expensive than before the pandemic

Sugar and sweets: up 5.1% from a year ago and 35.6% since the pandemic

Meanwhile, the price of dining out at a restaurant (formally known as full service meals and snacks) increased 4.4% from a year ago, capping off a 31.7% increase since the pandemic.

—Rent

Rent has become a key corner of inflation — and one of the costliest categories of a consumer’s budget. Prices, however, may finally be slowing, at least gradually.

Rent of primary residence rose 0.3% between June and July 2025, a clear cooldown from the post-pandemic peak of 0.8%. Over the past year, rents have risen 3.5%, now the lowest since the end of 2021.

Even so, Americans who’ve had to sign new leases since the outbreak are feeling the pinch: Rent is up 28.9% since the pandemic.

Rent prices have remained hotter than most economists and Fed officials originally expected. Lags could be one reason, as leases and housing agreements take longer to roll over from the previous year. Another could simply be because homes and mortgage rates have stayed pricey, keeping more renters on the sidelines than usual.

—Vacations

Inflation hasn’t just made the prices of key household essentials more expensive but the costs of vacations and travel, too. Airline ticket prices, for example, once soared as much as 43% from a year ago in September 2022.

Those prices are back to following the ebbs and flow of travel season, though consumers might still be experiencing some sticker shock:

Airfares: up 0.7% from a year ago but 8.1% cheaper than in February 2020

Car and truck rental: up 0.7% from a year ago, matching some of the biggest increases since 2022, and now 20.8% more expensive since the pandemic

Hotels and motels (lodging away from home): down 4.8% from last year and 5.1% more expensive than before the pandemic

—Car ownership

Owning a car has been especially pricey since the pandemic, from the cost of the car itself and the interest rates that finance it to the repair and insurance costs required for upkeep. Making car inflation hard to escape, the majority of households (roughly 92%) owned at least one car in 2022, according to the Census Bureau.

Motor vehicle insurance: up 5.3% from a year ago and 56.6% since the start of the pandemic in 2020

Vehicle repair: up 11% from a year ago and 58.4% since February 2020

New vehicles: up 0.4% from a year ago but still 19.8% more expensive since February 2020

Used vehicles: up 4.8% since July 2024, the biggest increase since September 2022, and 30.5% more expensive since the pandemic

Leased vehicles: up 0.2% in July from a year ago but 34.2% more expensive since the start of the pandemic

The different methods of measuring inflation: PCE versus CPI

Fed policymakers look at the full picture of economic data when setting interest rates. But officially, they prefer a different measure to see whether they’re succeeding at controlling inflation: the Department of Commerce’s personal consumption expenditures (PCE) index.

Lately, the PCE index has been indicating slower inflation, with overall prices now half a percentage point above the Fed’s target (2.6% as of June 2025, versus 2.7% in the same month for CPI). Excluding food and energy, “core” prices in June are up 2.8% from a year ago versus 2.9% in BLS’ gauge that month.

Those variations have always been afoot. Mainly, they’re because of methodology differences. For starters, PCE takes consumers’ substitutions into account (for example, one family’s decision to buy fish over meat for one month because it’s cheaper).

But another key difference is to blame lately. Both agencies estimate an item’s relative importance differently, with BLS’ gauge giving the most weight to the category of inflation that’s coincidentally been the hottest: shelter.

For Fed officials, the story remains largely the same: Inflation has majorly improved since peaking at a 40-year high back in 2022 but is still stubborn.

Takeaways for consumers

Slowing inflation in 2024 gave the Fed room to cut interest rates and consumers a chance to recover some of the purchasing power that they lost. Even so, prices are still higher today than they would’ve been had the pandemic not occurred, and the Fed remains worried that tariffs could reignite inflation.

—So long as inflation stays high, so will the borrowing costs you pay: The U.S. central bank’s key benchmark interest rate is still higher than at any point since the Great Recession — keeping borrowing costs elevated on the products consumers pay, from credit cards and auto loans to home equity lines of credit (HELOCs).

—Comparison shop as much as you can: Consumers know to compare offers from multiple lenders before locking in a loan. Why not the same for the items you buy on a regular basis? Compare prices at multiple retailers, see if any stores offer price match and craft a budget. If a product or ingredient pushes your spending goal over the edge, consider swapping it out for something else.

—Use the personal finance tools at your disposal: Finding the right credit card that helps you earn rewards on the purchases you were already going to make can be another way to pad up your wallet. Just be sure you’re not carrying a balance. A 20% interest rate will never outweigh the cash back.

—Save for emergencies and find the right account: Historically, investing in the stock market has been the best way to beat inflation over time, but higher rates mean savers can find a market-like return without any of the risk. Deposit rates have already fallen after the Fed’s rate cuts, but returns on high-yielding accounts are still beating inflation. Stash your cash in a high-yield account or add a certificate of deposit (CD) to your portfolio, so you can lock in these elevated yields for the long haul.

©2025 Bankrate.com. Distributed by Tribune Content Agency, LLC.

Comments