Target's sales continue to slide, and so does its stock

Published in Business News

Target reported another drop in quarterly sales and a steep decline in profits Wednesday, signaling continued challenges for the Minneapolis-based retailer.

As the financial results were released in the morning, the company’s shares took a quick 10% dive before the markets opened. Shares recovered modestly during the day and closed Wednesday at $98.69, down 6.3%.

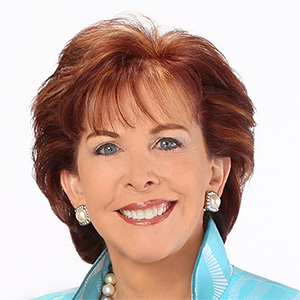

The financial results were released along with news that CEO Brian Cornell would cede his role to his second-in-command Michael Fiddelke in February.

Target has had inconsistent results for the past three years and some missteps. Its stock has fallen more than 30% over the past year.

Executives pointed out that sales results in all six of its categories were better than the quarter before. But total sales still fell 1.9%, even with a boost from online orders. Same-store sales fell more than 3%.

“To be crystal clear, you’re not going to hear me use language that sounds satisfied any time we’re talking about a quarter with a negative [comparable sales], but we were pleased to see progress across all of our categories,” Fiddelke, Target’s chief operating officer, said on a media call.

The 4.3% increase in digital sales were largely driven by same-day delivery and continued use of drive-up pickups.

Still, the business performed better than expected, said Rupesh Parikh, managing director of Oppenheimer. Results beat Wall Street expectations.

Some analysts are frustrated by the decision to name an internal candidate, which some suggest might pose issues for Fiddelke when addressing thorny issues facing the retailer.

There might also be some additional disappointment about Target not raising the lower end of its guidance as well, Parikh added.

He sees Fiddelke’s tenure as a “big advantage” from a “continuity perspective,” adding that his more than two decades with the retailer allow him to know the culture better than an external candidate.

Yet other analysts said Target has a long way to go to prove itself to Wall Street — and consumers.

“There is no external reason why Target should be experiencing this kind of weakness on the top line,” wrote Neil Saunders, managing director of GlobalData Research, in an analyst note. “This decline is entirely self-inflicted. Target, which used to be very attuned to consumer demand, has lost its grip on delivering for the American shopper.”

According to Placer.ai, Target saw 14% frequent visitor share — shoppers who visit at least four times per month — in the second quarter. It’s a modest increase from the previous year.

Walmart, on the other hand, experienced 34% frequent visitor share, highlighting Target’s role as a retailer driven largely by discovery.

“While strengthening essentials plays to the current economic climate and likely contributed to the modest increase in Target’s frequent visitors over the past year, the retailer’s future success depends on sharpening its core strengths,” the report read.

©2025 The Minnesota Star Tribune. Visit at startribune.com. Distributed by Tribune Content Agency, LLC.

Comments